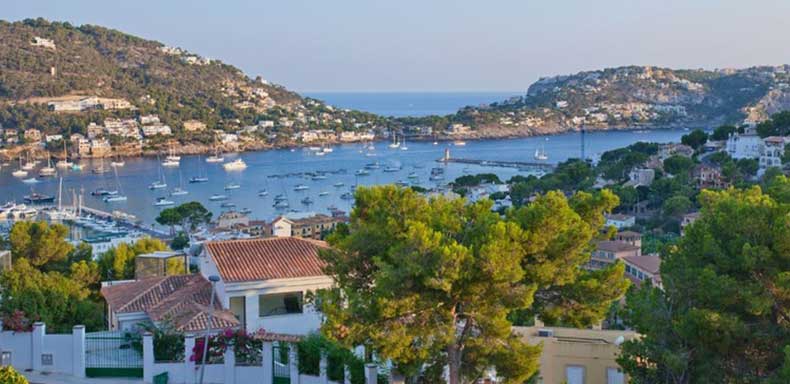

News about holiday rentals in Mallorca, what should you know?

A recent article published by the newspaper El Mundo makes a radiograph of the current situation of rental accommodation in Mallorca.

In the same, is exposed the boom in both tourist and urban leases carried out through large digital platforms that have established Mallorca as a strategic destination.

As part of this business boom, has exploded the underground economy in the holiday rental sector in the Balearic Islands, in the form of illegal tourist rental.Despite the fact that are being promoted as mere intermediaries between owners and renters behind them there is a spectacular business. Contrary to what happens with hosting companies regulated, in the case of digital platforms, it is unknown whether or not users pay taxes. In fact, in many cases, the same platforms recognize that on their own web pages may have hidden businesses that violate the Tourism Law of the Balearic Islands , which expressly prohibits offer this type of property for tourist channels, and avoid thus the payment of the tax.

The absence of a clear regulation has generated many doubts in Europe about how to monitor the management of these platforms, so that the Spanish government has authorized Autonomous Communities to control and punish them, if is applicable.

Private individuals can perfectly rent their flats under the Law of Urban Leases (LAU) without registration in the register of Govern and thus avoiding paying the eco-tax, as this state law permits short leases, so that until not modify this law, there will be this kind of rent. In the Balearics is forbidden to rent flats for tourist use, although single-family homes, where tourist services won´t be offered or the property announced on tourist channels.

It isn´t a legal problem the fact that the owner of an apartment or villa that is not qualified as a tourist can rent it per season if the services are not offered. Similarly, advertising the same channels of tourism, which is forbidden by the Balearic legislation is not enough to determine that there is infringement, since according to the LAU would also be necessary that housing was subject to a specific regime. The infringement is in the fact that the owner rents its property as tourist when the property is not qualified in this way, thus avoiding the payment of the eco-tax, so that tourists staying in their properties do not pay tax.

Avoid this problem is possible renting your holiday villa or apartment through a specialized and experienced company. With over 15 years of experience in the Mallorca Holiday Villas industry, Balearic Villas have the experts & the know-how to create the perfect, independent-living holiday for you. As a rental division of the real estate leaders of Balearic Properties, Balearic Villas specializes in holiday rentals of luxury villas and apartments in Mallorca, Ibiza and Menorca.